The car insurance companies blog 4115

AboutFascination About Here's Exactly How Much To Save Each ... - Arizona Daily Star

In Washington, motorists with excellent credit pay approximately $84. 61 per month compared to motorists with poor credit who typically will pay $123. 77 per month. Credit Rating, Avg monthly rate Excellent $84. 61 Great $77. 16 Poor $123. 77 Motorists with an excellent driving history typically will pay less for automobile insurance coverage than someone that had a DUI, speeding tickets, or a mishap.

In Washington, drivers who own their home will usually pay around $77. 21 monthly while chauffeurs who lease typically typical in around $79. 12. Homeownership, Avg regular monthly rate Own $77. 21 Lease $79. 12 Usually, chauffeurs who currently have vehicle insurance protection will get a cheaper monthly rate than motorists who do not.

What Does Auto Insurance Rates Rise, But Insurers Brace For Higher Costs ... Mean?

In Washington, the average monthly rate for a motorist who is currently insured is $69. 17 Coverage, Avg month-to-month rate Not Currently Guaranteed $472.

In (State) the typical rate for liability only protection is around $63. 86 per month compared to Full coverage which will cost you about $79. Protection, Avg monthly rate Full Protection $79.

Things about Car Insurance Estimator - Coverage Calculator - Geico

The rates and averages shown on this page must just be utilized as a quote.

That's how simple it is. With My, Get more information Policy, you can see your policy online and make changes or renewals. Use our award-winning The General intuitive mobile app to perform these exact same tasks or file a claim. Do I get a discount rate if I pay my policy in complete? In most states, consumers paying in full get discounts.

Things about Understanding Supplemental Security Income Ssi Resources

Life Occasions Life occasions, such as moving or marriage, can have a considerable effect on the quantity of auto insurance protection you require to think about. Vacating state? The amount and kinds of coverage you're required to have might change. Own a house? You might need to think about higher limits for much better defense.

Our vehicle insurance coverage calculator assists take life events such as marital status and homeownership into account. Coverage You can personalize the quantity of coverage you purchase for your circumstance. You'll require to think about if you desire the most affordable quantity of protection your situation enables. Will your coverage provide the protection that fits your needs? Or do you choose a greater level of protection to provide you with assurance in case of a mishap? Vehicle Ownership Is your vehicle financed or rented? This may affect the vehicle insurance coverage you are needed to have.

Not known Facts About Average Cost Of Car Insurance In The Us For 2021 - Usnews ...

Our cars and truck insurance calculator takes these things into account when approximating your coverage needs. Time Spent Driving The quantity of time you spend on the roadway matters when determining how much protection you might desire to bring. More time driving can increase your danger of being in a mishap, so you might wish to carry more protection.

In addition to the insurance coverage business you choose, factors such as your age, automobile make and model, and driving history can impact your premium, so what's best for your next-door neighbor might not be best for you. How Much Does Automobile Insurance Coverage Cost?

Excitement About Tesla's Discount Car Insurance Rolls Into Another State - Yahoo ...

Before we actually get into the elements that can affect a premium, let's take a look at some typical payments merely based upon low or high levels of protection. Typically, getting the minimum liability insurance coverage is less expensive than a complete protection policy. It might be best to pay for more coverage rather than pay for high repair bills down the line.

Young males normally get greater quotes than young women since research studies by the Insurance coverage Institute for Highway Security reveal more young men end up in mishaps. In the same way, a research study by the Customer Federation of America found that older females crash more frequently than older men, suggesting that typical automobile insurance coverage payments for older women can be somewhat greater.

What Does How Will Your Social Security Benefits Stack Up To The ... Do?

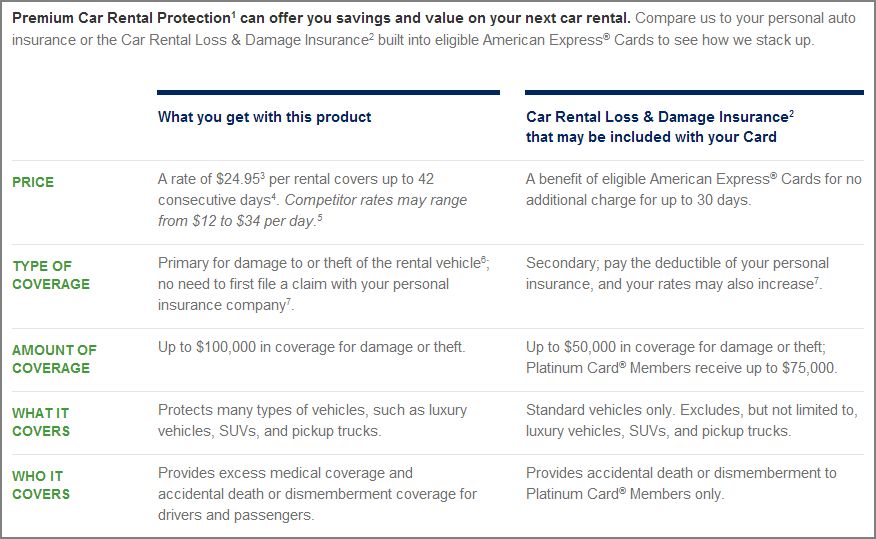

Many insurance companies take your credit rating into factor to consider when figuring out how much you will pay for automobile insurance coverage. Automobile insurance coverage business often change rates according to your job.

New cars cost more to replace in case of an overall loss, so accident coverage is more expensive. Every car on the market goes through the security ranking process. Automobiles with high security scores offer a lower possibility of major injuries, meaning your insurer will have fewer medical costs to pay.

Things about Here's Exactly How Much To Save Each ... - Fremont Tribune

Your deductible can likewise impact how much your automobile insurance coverage premium costs. How Much Is Car Insurance For Different Ages And Genders?

These departments also choose how insurance provider evaluate threat and identify average automobile insurance rates for state citizens. With that being said, a lot of states require that all motorists bring certain amounts of liability vehicle insurance coverage. Numerous states run a no-fault system, indicating chauffeurs' insurance coverage companies are accountable for any injuries and residential or commercial property damage regardless of fault, so that impacts required protection too.

Not known Details About 11 Best Dental Insurance Plans Of 2021 - Money

Because of this, rates differ significantly from individual to individual. This is why we recommend getting quotes from several insurance business. With that being stated, several of the above-listed business offer competitive rates.

As you can see from the data, USAA cars and truck insurance has some of the most affordable average rates in the industry by far. This, in addition to its great client service, makes it one of our top options for car insurance. Nevertheless, USAA is just readily available to existing and former military and their relative.

The Greatest Guide To Average Us Car Insurance Costs By State For 2021 - Kelley ...

https://www.youtube.com/embed/7FBHDc1FEY8Approach In an effort to offer precise and unbiased info to customers, our professional review team gathers information from lots of vehicle insurance coverage service providers to formulate rankings of the very best insurers. Business receive a score in each of the following categories, along with an overall weighted score out of 5.

AboutAll About Best Ways To Lower Your Car Insurance Costs - Finder.com

Some associations, companies, or staff member groups have insurance coverage plans readily available to members to buy automobile (or other) insurance through unique arrangements with insurance provider. In some cases, the insurer may automatically accept all group members for insurance coverage or only those members meeting their requirements. Group plans for insurance coverage may save you cash, nevertheless, they may not constantly do so.

Many chauffeurs presume there's absolutely nothing they can do to lower their vehicle insurance premiums other than to change their provider. It is not true. There are some a driver can require to affect the rate they pay for car insurance. In this article, you'll find out 15 ways you can require to decrease your automobile insurance coverage premium.

Unknown Facts About Can You Negotiate Car Insurance Rates? - The Zebra

Moreover, the idea that a red automobile costs more in insurance is false. When it pertains to the car you drive, the year, make, model, body style, and age are what insurers aspect in when creating a quote. Age and Gender, Fully grown motorists normally have fewer accidents and much better driving records than inexperienced teen chauffeurs.

Insurance providers also base rates on gender. Women tend to enter into fewer mishaps and get fewer driving-under-the-influence (DUI) accidents than males. They tend to pay less for automobile insurance coverage up until age 40, when the trend reverses. Vehicle Insurance Coverage, Your automobile insurance limitations, deductible, and policy choices can all affect how high your rates might be.

What Does How Do I Lower My Car Insurance? - The Drive Mean?

For how long Does It Consider Insurance to Decrease? Business utilize different methods to determine your premiums. These calculations depend upon the provider and the driver's area. Insurance coverage business likewise think about whether the mishap was small or significant and whether it was your very first or numerous claims. One good idea: if you have a mishap, your vehicle insurance rate boosts won't last permanently.

California lists points from small accidents on a driver's record for 3 years. Your rates will increase after a mishap in the following circumstances: You're at fault for an automobile accident.

Examine This Report on How To Lower Car Insurance Premiums - Farmers Insurance

Mishap results in serious physical harm or death, Your rates may not increase after a mishap when: The other driver is 100% at fault. New chauffeurs and long-time chauffeurs can benefit by enrolling in and completing a motorist training course.

Young and unskilled drivers can conserve practically 10 percent discount rate when they complete an authorized chauffeur training course. Fully grown chauffeurs can also cut their rates when they take a defensive driving course.

The Single Strategy To Use For How To Lower Car Insurance With These 13 Tips - The Motley ...

Vehicle insurer consider a credit-based insurance rating to determine your automobile insurance rates. These scores anticipate the probability that a client will file an insurance claim that will cost the provider more money than it gathers in premiums. Credit scores and credit-based insurance coverage scores have various functions, they both consider similar habits.

The best place to learn about your credit is to request a copy of your credit report. Additionally, you should make a mindful effort to pay all your costs on time.

The Single Strategy To Use For How To Lower Car Insurance Costs

With some effort, you will raise it, which will help decrease your auto insurance coverage rates. Get a various automobile. Your cars and truck insurance rate can vary depending upon the kind of car you drive. If you are in the process of getting a new automobile, you need to contact your car insurance provider to find out the models that have lower relative rates.

The variety of miles you drive every day can impact your vehicle insurance coverage rate. You can move more detailed to work, take public transport, carpool and even take a shorter path. There are many things you can do to drive less. Driving less will also conserve you cash on gas and lower the upkeep expenses of your automobile.

Getting My Does Car Insurance Go Down At Age 25? - Valuepenguin To Work

Numerous cars and truck insurance providers use discount rates when you have multiple policies with them. While you might think moving your homeowners policy from one insurance company to another is an inconvenience, your automobile insurance coverage agent will be more than willing to help you assist in that procedure. Bear in mind that many kinds of insurance coverage might offer discount rates when you bundle.

Insurance provider describe bundling as buying numerous policies from the exact same insurance company. Many business use multi-policy cars and truck insurance discount rates when you bundle several automobiles on the very same policy. If you are married and own 2 vehicles, you may be able to conserve a considerable quantity on your vehicle insurance rates when you insure both lorries together than if you individually guaranteed them.

4 Easy Facts About How To Lower Your Car Insurance Premiums - Clovered Described

Lenders need you to carry a minimum level of coverage when you lease a lorry or finance an auto loan. This insurance coverage assists to secure the finance company's financial investment simply in case they require to repossess the automobile. If you have a note or loan on your vehicle, your loan provider will require that you have a minimum level of protection on your car to protect the value of your car.

Prepay your policy. If you are financially able to pay for your car insurance 6 or 12 months ahead of time, you might be qualified for a discount from your cars and truck insurance company. This discount will minimize the overall amount you need to spend for your cars and truck insurance. Move. Where you live can have a direct impact on what you pay for your automobile insurance.

The Greatest Guide To At What Age Do Car Insurance Premiums Go Down?

Submitting one might result in greater premium rates in the future given that every claim made is tape-recorded on your vehicle insurance coverage company's insurance policy holder record. After an at-fault claim, most business will charge you extra for up to 3 years.

You can get the finest insurance rate by comparing vehicle insurance coverage estimates from a number of companies. Simply enter your postal code on this page to get started. We'll offer you with rates and premiums from regional insurance coverage business within your location. When Should You Lower Your Vehicle Insurance? Many states require drivers to buy a minimum quantity of insurance coverage to drive on their roads.

The Of Does Car Insurance Go Down At Age 25? - Valuepenguin

A lender or bank might need an insurance policy holder to purchase this protection when they have a vehicle loan or rent a vehicle. There are numerous tips to consider prior to you drop car insurance protection.

https://www.youtube.com/embed/dS6iedY0wkc

Due to the fact that the customer assumes a fraction of the general cost of a claim, the larger the deductible, the less expensive the yearly or monthly premium might be. Let's presume your automobile insurance plan has a $5,000 protection line. Your insurance provider will cover you for $4,500 if you have a $500 deductible, whereas a $1,000 deductible suggests your insurer will just cover you for $4,000.

AboutSome Ideas on How To Save Money On Car Insurance For Your Teen You Should Know

Student Away Discount Rate: If your teen is away for school and not driving, ask your provider about an "away" discount. This can save you around 5%-10%. Raise Your Deductible: This simply implies you raise the amount that you are accountable for covering in case of an accident and is an easy method to lower car insurance coverage premiums.

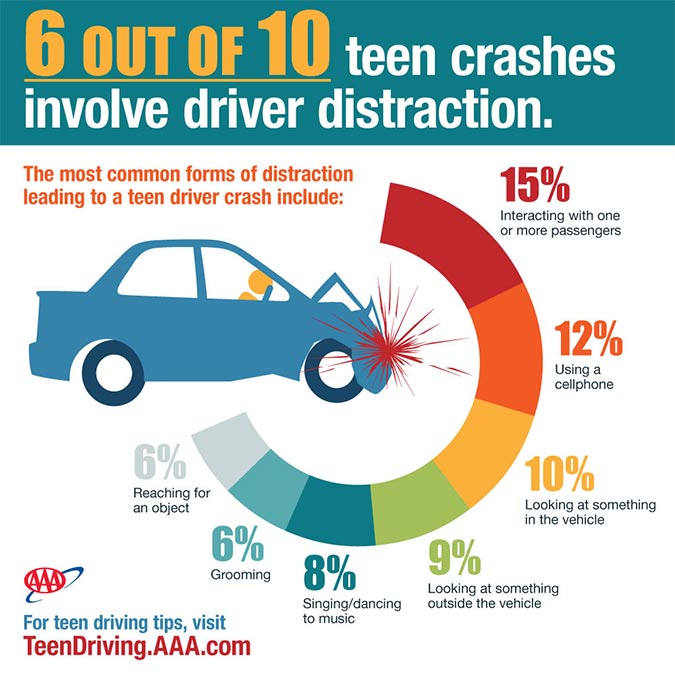

Great driving practices are key to keeping insurance coverage premiums low and affordable. Be sure to talk to your teen about safe driving habits and be sure you model those safe driving routines to them.

The Single Strategy To Use For At What Age Do Car Insurance Rates Go Down? - Money ...

South Carolina has some of the most distracted chauffeurs on the roadway! South Carolina ranks in the leading 5 in the nation for fatalities per 100 million vehicle miles took a trip. 982 individuals died in traffic mishaps on our state roads in 2017. That relates to one death every nine hours.

Klaus Vedfelt, Getty Images Vehicle insurance coverage for young, inexperienced chauffeurs isn't cheap, and for good reason. Teenage motorists between the ages of 16 and 19 are most likely to be involved in mishaps than any other age, as stated by Webb Insurance. For parents with teens who are quickly approaching the driving age, finding out how to save on teenage car insurance coverage is a necessity.

The How To Insure Teen Driver PDFs

If your teenager makes the dean's list or is on the honor roll, share that details with your insurance supplier, as it might help with lower rates too. Till your teen reaches age 25, getting excellent grades could lead to a discount rate that varies anywhere from 5 to 15 percent, depending upon the provider.

Particular vehicles, such as cars, currently posture a higher danger for insurer. Putting a teenager behind the wheel of a lorry the business thinks about high-risk is going to increase the quantity you pay each month for insurance coverage. Many insurance companies consider these lorries to be the best options for teenagers: Volkswagen Jetta, Toyota Camry, Ford Taurus, Subaru Forester, While it's not mandatory that your teenager drive among the cars on this list, a four-door sedan will help you save the most cash on teenage vehicle insurance.

The Single Strategy To Use For Ultimate Guide To Massachusetts Teen Drivers And Auto ...

According to Money Talks News, insurance coverage companies can utilize telematics devices to track your driving routines. Talk to your insurance provider to find out if they have a gadget they can set up in your lorry that tracks things like your braking routines, driving speed, the range you travel usually, and how often you drive.

Of course, they will collect this information your teenager. Shopping Around, Even if you have an excellent insurance coverage supplier, prior to you add your teenager to your policy, you might wish to go shopping around. Every insurance coverage company offers various rates and discount rates, so get quotes from other vehicle insurance suppliers to see how they compare.

The Greatest Guide To Ways To Reduce The Cost Of Insurance For Teens In New Jersey

Plus, getting quotes does not indicate you have to make a commitment to any of the companies you ask with. A lot of insurance coverage companies have discounts you can take advantage of, which is essential when you're including a teenager to your policy.

While this might appear simple, you'll have to analyze your own driving practices. Prior to you can teach somebody else to be a great driver, you need to set an example by being one yourself. When driving, make sure you stay within the speed limitation, utilize your turn signal, and concern a total stop at stop indications.

Not known Factual Statements About How Much Does It Cost To Add A Teenager To ... - Creditdonkey

.jpg)

Having a clean driving record without accidents or moving infractions is among the very best methods to get a low rate on your cars and truck insurance coverage. If your teenager can drive without having mishaps or other offenses on their driving record, they'll end up with a much lower rate while they're on your policy.

On the very same note, if your teenager goes on a trip or isn't driving for a certain period, let your insurer understand, as they may provide you a discount. It's likewise essential to keep in mind that if your teen drives an insured lorry for less than 25 percent of the time the car is on the roadway, you can receive a cheaper rate.

The Single Strategy To Use For Best Cheap Car Insurance For Young Adults For 2021

Teens are more most likely to be associated with accidents and have actually proven to be greater risks for insurance provider. Look at how to save money on teenage cars and truck insurance coverage prior to they take this huge action towards their independence. This content is created and maintained by a 3rd party, and imported onto this page to assist users offer their email addresses.

https://www.youtube.com/embed/lmRep5MXsB0

When it concerns teen drivers and cars and truck insurance coverage, things get complicated-- and pricey-- quickly. A moms and dad adding a male teenager to a policy can expect automobile insurance rate to balloon to more than $3,000 for complete protection. It's even greater if the teenager has his own policy.

AboutLittle Known Facts About Auto Insurance Discounts.

On the other hand, foreign and high-end automobiles are thought about a high-risk for vehicle insurance coverage companies due to the fact that parts are expensive. Numerous motorists see reductions in car insurance rates after they gain more driving experience, avoid getting tickets, and prevent accidents.

It all depends on the quantity of driving experience you have and for how long you preserve a safe driving record. If you get your license right when you turn 16 and preserve a clean driving record for a few years, you ought to start to see lower rates once you reach your mid-20s.

This two-year driving history may not be long enough to prove to insurance provider that you have decreased your danger. To preserve a clean driving record, keep these safe driving suggestions in mind: Limit the variety of other teen guests and distractions. Never drive with your phone in your hand or while eating.

Our Recommendations For Automobile Insurance Coverage Regardless of your age, you must go shopping around to discover the finest vehicle insurance coverage rates. Each business uses its own benefits and value, so it's up to you to choose what you require from your insurance service provider.

What Age Does Car Insurance Go Down? - Policygenius for Dummies

Other items that may be thought about consist of how long you have actually been driving, your driving record, and your claims history. Why Rates and Quotes May Differ To help guarantee you get a precise quote, it is necessary to offer complete and accurate details. Incorrect or incomplete details can trigger the quote amount to vary from the real rate for the policy.

If you exclude info in the pricing estimate procedure about accidents you've been in (even small ones), your policy rate might be higher. If you forget to provide information about your loved ones' driving history, such as speeding tickets, this may result in a higher rate. Ensuring you have the best information can make the process of getting a quote simpler.

:max_bytes(150000):strip_icc()/womanonphone-3613b61aa5b243c6abbc3ac9bc9576fd.jpeg)

You're sharing the danger with a swimming pool of motorists. Insurance coverage works by transferring the threat from you to us, your insurance coverage company, and to a big group of other individuals.

If you have actually had your cars and truck for more than a couple of years, you may have seen that your automobile insurance premiums increase every year. At every renewal, you might have paid a higher premium price for the same level of protection. Have you ever questioned why does that occur despite a reduction in the value of your car due to devaluation? This post will inform you the factor for a yearly boost in the rate of cars and truck insurance cost and what ought to you do to keep them low.

Facts About 7 Ways To Lower Your Auto Insurance Rates - Ama Revealed

For the unversed, 3rd party insurance assists the insurance policy holder to get financial help from his/ her motor insurance company in case an accident leads to any 3rd party claims. The IRDAI or the Insurance Coverage Regulatory & Advancement Authority of India establishes the 3rd celebration insurance coverage premium rates for all automobiles.

After considering these elements, the IRDAI declares the 3rd party premium rates for the next financial year. In India, every automobile needs to have a 3rd party cover under his automobile insurance plan. Based on the Motor Vehicles Act, 1988, motor insurance coverage with third celebration coverage is a legal obsession for all cars plying on public roadways in India.

As an outcome, the automobile insurance coverage premiums increase every year for 3rd party insurance as well as extensive vehicle insurance. The 3rd party insurance premiums rates for the financial year starting in April 2020 are provided in the following table. The rates will stay unchanged till more orders by the IRDAI.

A risky motorist is a larger liability for the insurance provider and thus, is charged a greater automobile insurance coverage premium. 3rd Party Premium Rates Third party cover belongs of every automobile insurance policy, be it 3rd party or comprehensive automobile insurance coverage. Hence, every car insurance premium is inclusive of third celebration premium cost decided by the IRDAI.

The Single Strategy To Use For 9 Benefits Of 6 Months Car Insurance Premiums (2021) - Insurify

Insured Declared Value (IDV) The Insured Declared Value is the optimum claim amount which the insurer will pay you in case of an overall loss. A higher IDV implies the insurance provider will need to pay a higher claim amount and thus, it imposes a higher liability on the insurer.

Age of the Automobile When it comes to determining the premium for a cars and truck insurance policy, the older the car is, the much better. This is because brand new cars attract higher premium rates than older cars due to no depreciation. Every automobile experiences devaluation gradually and its value reduces with each passing year.

Place of the Policyholder Automobile insurance coverage premiums are identified based on the possible risks and risks to an automobile. If you reside in an area which is more susceptible to accidents, catastrophes or civil discontent, a greater danger looms over your cars and truck than a vehicle whose owner stays in a reasonably safer region.

For this reason, your vehicle insurance coverage premiums will be higher if you remain in a risky area. Driving Routines Some motor insurance companies might likewise examine your past driving records before offering a cars and truck insurance quote. This occurs due to the fact that driving records can assist the insurer to understand your driving habits and how typically you break traffic guidelines.

How To Reduce Your Car Insurance Rate Can Be Fun For Everyone

Prevent Raising Minor Claims Each time you make a claim, your NCB brings back to zero and you will need to restore it. Thus, you must prevent raising claims that you can manage. In case your vehicle has sustained small damages, getting it repaired will not be very costly. If you raise a claim for such minor damages, you will lose your collected NCB that could have helped you save more money on renewal premium than the cash invested on the repair of the automobile.

Skip Purchasing Unneeded Add-Ons Add-on covers are the additional defense that you acquire for your cars and truck on paying a higher premium. Engine secure cover, nil devaluation cover, and so on. Nevertheless, not every add-on cover is necessary for all sort of cars and trucks. There is no requirement to purchase tyre protect cover for a brand brand-new vehicle as its tires are likely to be in great condition for at least a couple of years.

https://www.youtube.com/embed/JSIW55BOTHs

Renew Your Automobile Insurance Coverage Policy on Time It is crucial to renew your vehicle insurance coverage prior to the expiry of the existing policy. Not just does it ensure continued security of your vehicle however also keeps your NCB safe.

AboutNot known Incorrect Statements About Cheapest Car Insurance For First-time Drivers - Wallethub

How much does automobile insurance coverage generally cost for first-time drivers? Numerous factors enter into figuring out the typical expenses of vehicle insurance coverage consisting of age, gender, area, company, coverages, and the vehicle. Rather than settle on averages, why not discover your expense with real quotes from numerous business in just a few minutes at.

He and his other half chase their five kids in the Phoenix, Arizona sun. You can find out more at.

Consider the ramifications of this a 3rd of drivers are disappointed, yet most continue to restore their policies without taking the time to buy alternative choices. business know this, and they are understood for raising rates at the time of policy renewal, which usually occurs every 6 months or every year.

Cheapest Car Insurance For First-time Drivers - Wallethub - The Facts

For beginners, it avoids you from presuming that one business in specific is the most affordable. One company might be more forthcoming than another when it comes to a Go to this website specific function of their policy.

Obviously, you'll want to find a plan that fits your spending plan so superior payment is most likely the first thing you'll think about. However you'll also wish to take into account the deductible, i. e. the rate you'll pay if you submit a claim, along with protection locations. Some plans cover damage from uninsured motorists, and others don't.

This will give you a real idea of what the expenses will be in the event of a mishap. It's tempting, but don't lie, When faced with rising premiums, you might be tempted to "fudge" your numbers to get a lower rate.

Some Ideas on How To Buy Car Insurance For The First Time - Policygenius You Need To Know

While you may take pleasure in lower premiums if you take this path, all of these lies will pertain to the surface if you sue. In this case, you could be on the hook for the entire expense of damages since your policy would be rendered inapplicable, considering that the rate you were paying was not for the fact of your circumstance.

On average, consumers who shop around can conserve as much as 47% in premium costs, or as much as $847 per year. Even if you just conserve a portion of this, a $200 savings is money that can be well invested (or saved) somewhere else.

You can follow Megan on Twitter and at . Read more Check out less Associate Editor, Insurance Coverage.

7 Simple Techniques For Car Insurance - Custom Auto Insurance Quote - Liberty Mutual

Understanding commonly-used terms used on the car insurance coverage policy will help you know your coverage better. Prior to you start browsing for the ideal vehicle insurance coverage policy or insurer go through the following list of auto insurance coverage lingos: First-party and Second-party: The extremely first thing you will discover when you buy cars and truck insurance coverage is your function as a buyer.

An insurance business which is insuring the cars and truck becomes the Second-party. Own Damage(OD): Any damage to the insured car or injuries to the owner of an insured cars and truck is termed as Own Damage.

Depreciation: Reduction in the monetary value of the automobile with time. Car insurance can be of two types, Third-party Car Insurance Coverage and Extensive Vehicle Insurance Coverage. Third-party Automobile Insurance coverage is necessary based on The Motor Automobiles Act, 1988. It covers third-party liabilities. A Comprehensive Automobile Insurance Policy supplies a larger coverage as compared to Third-party Liability policy.

The 15-Second Trick For How To Buy Your First New Or Used Car - Consumer Reports

Roadside Support: On road facilities like towing, small repairs, fuel, battery jumpstart, etc can be availed with this cover. Go back to Billing: In case of overall loss of the automobile, the amount discussed on the invoice will be compensated to the policyholder. Engine Protection: Covers the cost of repairing/replacing the engine of the insured car.

Vehicle Details, Car details are absolutely nothing but the registration number and engine capacity of your vehicle. Engine capacity is also a crucial element to determine the quantity of insurance premium.

Getting in proper individual information will be helpful at the time of claims. You can purchase either of the two types of cars and truck insurance policy, i. e. Third-party Liability or Comprehensive Policy. The difference in these 2 types of policies is the degree of coverage offered.

Do You Have To Have Insurance To Buy A Car? - Everquote Things To Know Before You Get This

There you go! Describe this ready-made list while buying insurance and you will buy the policy like a pro although it is your very first time. Likewise, read: New car insurance coverage.

It's 2020 and at the start of the new year is a great time to check to make certain you are getting the absolute best car insurance rates for your cars and truck. Since if you drive a cars and truck, you require automobile insurance coverage and why not take a few extra minutes to check? Naturally, every state requires that you buy a minimum of a very little amount of liability protection to ensure that if you harm someone else's home while operating your automobile, a few of that is at least looked after.

If you're an occupant or homeowner, you can access those policies through Gabi. The rate quotes are free and you don't pay any costs for using the service, even if you select to acquire a policy through them. But among the finest things about Gabi is that it does not stop conserving you money once you've registered.

Getting My The Guide For First Time Car Insurance Buyers - Ball State ... To Work

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/african-teenager-in-car-with-father-74956310-5c17c08246e0fb0001e03814.jpg)

This guarantees your rates stay low. And notably, Gabi customers conserve $961 typically annually. Liberty Mutual Liberty Mutual has some of the best representatives and customer care in the industry and was voted second for customer satisfaction in a 2012 research study by J.D. Powers. Representatives generally parter with community organizations and employers to sell policies, anyone can get a quote and a policy from Liberty Mutual.

New vehicle replacement: If you purchase a brand name brand-new cars and truck and remain in a crash within the first year, most insurance coverage policies will only pay the depreciated value of the automobile which can be thousands less than you simply paid for the car. New vehicle replacement with Liberty Mutual makes sure that you'll get adequate cash to buy the exact same new automobile again.

https://www.youtube.com/embed/nCrrWNCe0Vg

Progressive promotes its standing as the number one car insurance website, and assures to assist you find the best rates even if the finest rate is with a company besides Progressive. It's not a bad location to start your search, considering that you can see numerous quotes from multiple companies.

AboutThe 10-Second Trick For Buying Car Insurance? 7 Common Mistakes To Avoid - The ...

Get Low-cost Automobile Insurance Coverage with GEICO Are you searching for low-cost car insurance but worried about sacrificing quality and service in favor of a more cost effective rate? GEICO has you covered. The word "inexpensive" might be scary when it concerns a vehicle insurance coverage, however it does not need to be this method.

It's budget-friendly. All while supplying you with 24/7 consumer service and top-of-the-line insurance coverage for your automobile. Here at GEICO, quality does not fall by the wayside when it comes to providing customers with budget friendly vehicle insurance and terrific customer service.

Exist runs the risk of to getting low-cost car insurance coverage? Cheap rates need to not indicate you need to opt for minimal policy protection options, high deductibles, bad client service, and an absence of important security functions like emergency roadside service. Things are different with GEICO, where inexpensive vehicle insurance coverage doesn't change the remarkable service, features, and coverage options that our car insurance policyholders get.

Some Known Details About Verti Insurance: Pennsylvania Car Insurance Made Human

You're that much closer to signing up with the lots of who have actually conserved hundreds on their vehicle insurance. GEICO insurance policy holders are surrounded by money-saving chances that can make their vehicle insurance rates more budget-friendly.: By switching to GEICO, students might save $200 on an automobile insurance policy.

is important for any driver (it's even necessary in 48 states), but it's especially crucial for new motorists, whose inexperience makes them more most likely to have mishaps. Discovering the right policy, however, can be a challenge. What sort of protection do you require? How do you balance cost and coverage? Do you really require accident protection? It's a lot-- but we're here to assist.

Facts About Add Teen Car Insurance To Your Policy - State Farm Uncovered

Nationwide 5 things to do before picking a cars and truck insurance coverage business for a teenager, Decide if you're getting a different car insurance coverage for your teen or if you want your teenager listed on your insurance. The former is usually considered less expensive in the short-term as your own vehicle insurance premium will not increase.

Choose which car insurance coverage advantages are essential to you, and make certain to look out for them when speaking to an insurance agent. Many insurance companies will not extend accident forgiveness to more youthful drivers, however Nationwide will. Inspect which car insurance coverage discount rates your teen might be eligible to get.

Leave it to Geico to provide budget friendly vehicle insurance that makes things simple and simple, no matter the job. Geico's individual policy rates differ on a state-by-state basis, but it's regularly ranked among the most affordable options in any state.

The Buzz on Best Cheap Car Insurance For Young Adults For 2021 - Us News

It also uses the very same discounts as a lot of its rivals, consisting of benefits for excellent students and for chauffeurs who have actually taken driving training courses. Likewise impressive is that teens that transition from a family policy to their own auto insurance might receive a 10% Tradition discount on their insurance coverage.

Nationwide Cars and truck insurance is more pricey for teenagers because of the perception that their inexperience makes them most likely to be associated with accidents. Whether this holds true or not, the truth remains that one in 5 16-year-old chauffeurs gets an accident on their driving record in their first year behind the wheel.

Nobody wishes to invest a lot on an automobile insurance coverage, especially when the car in concern might only be used on unusual events. Just the thought of costs thousands a month in insurance coverage costs on a car that's usually in a parking area is stress-inducing. Not just does Progressive provide daily low costs, but it's also produced a series of discount rates that use specifically to college students.

Little Known Facts About Cheap Car Insurance For New Drivers Under 21: What To Know.

Teenagers can also make the most of Progressive's Photo program, which rewards chauffeurs for driving securely with discounts and other cost savings. Progressive's website likewise offers a list of ideas to assist parents figure out if they ought to add teens on their strategies or get them their own. Erie Insurance Pennsylvania-based Erie Insurance coverage has actually been insuring drivers for nearly 95 years, and its credibility for sterling service extends to young motorists.

"If there is a young chauffeur on your policy who is ... away at college without a vehicle," says Ruiz, "you might likewise get approved for a lower rate." Every insurance carrier offers different discounts depending on your protection choice and other elements, so it pays to inspect which ones apply to you prior to signing up.

It's likewise a fact that teen kids are more pricey to include to a policy than teen girls, as they're more likely to be included in a major vehicle accident. Progressive offers a variety of discounts for college students to save money on vehicle insurance coverage. Progressive How do you choose the very best protection? The finest coverage for you is the one that fits your requirements, addresses your issues, and makes good sense for your scenario.

The Driversed.com: America's #1 Driver Education Courses Online Diaries

It's 2020 and at the start of the new year is a good time to examine to make certain you are getting the extremely finest automobile insurance coverage rates for your car. Since if you drive a vehicle, you require auto insurance and why not take a few extra minutes to check? Of course, every state needs that you acquire at least a minimal amount of liability protection to ensure that if you damage another person's home while operating your vehicle, a few of that is at least looked after.

If you're a renter or property owner, you can access those policies through Gabi, as well. The rate quotes are free and you don't pay any costs for using the service, even if you pick to purchase a policy through them. But among the very best features of Gabi is that it doesn't stop saving you cash as soon as you have actually registered.

This ensures your rates remain low. Agents typically parter with community organizations and companies to offer policies, anybody can get a quote and a policy from Liberty Mutual.

All about Cheapest Car Insurance For Teens (And Their Parents)

https://www.youtube.com/embed/uuGRatbq6NkNew vehicle replacement: If you purchase a brand brand-new car and are in a crash within the first year, the majority of insurance coverage policies will just pay the diminished worth of the automobile which can be thousands less than you simply spent for the vehicle. New cars and truck replacement with Liberty Mutual guarantees that you'll get adequate cash to purchase the exact same brand-new cars and truck again.

AboutEverything about California Auto Insurance Coverage

can set its own requirements. These typically include bodily injury liability and home damage liability. Some states likewise require insurance coverage for uninsured or underinsured motorists. Some need medical payments coverage. Your lender may need just that you satisfy your state's minimum requirements if you're financing your vehicle, or it might require collision and thorough as well.

Your provider might provide other choices. Medical Payments and Accident Protection Medical payments and individual injury defense are provided at the level set by state law. These help pay the costs of care for you or others who remain in the car with you. It might likewise cover lost salaries and other expenditures that come from injuries suffered from the mishap.

Their insurance, if any, might not be adequate to pay for medical expenditures. Examine with your state to see what it needs.

Excitement About Automobile Coverage Information - Ct.gov

Your lending institution may need this coverage if you purchased your automobile with a loan. Comprehensive Insurance Comprehensive coverage pays for damage to your vehicle that wasn't caused by a crash.

Comprehensive insurance coverage assists pay for damage to your car that is outside of your control. Other Optional Coverage You may think that towing and cars and truck leasings are consisted of with full coverage.

You should request it if you're getting a loan for a big part of your vehicle's value. You'll have to spend for that "gap" expense unless you have this protection if you owe more on your loan than your automobile is worth, and you have a mishap or your cars and truck is stolen.

The smart Trick of What Does Comprehensive Auto Insurance Cover? - Money ... That Nobody is Discussing

This protection often doesn't come immediately with a complete coverage policy. Do I Need Complete Coverage? Some coverages are needed by law or by loan providers.

But keep in mind that you'll spend for that protection through high premiums. You may elect to select less coverage or higher deductibles if you have a lot of money conserved so you might take in much of the cost of an accident. Medical expenditures from an accident can be far more expensive than purchasing a new car.

You know you need cars and truck insurance coverage, however do you require full protection? While liability car insurance coverage covers damages triggered to others in a mishap, detailed and accident insurance coverage covers damages to your automobile. Collision normally covers damages that are your fault, such as during an accident with another vehicle, and comprehensive covers circumstances where you may not have actually been included at all, such as having your cars and truck stolen.

The Automobile Insurance Guide Diaries

Specifying Complete Coverage Car Insurance Coverage, Coverage Type, Comprehensive, Comprehensive insurance coverage covers damages to your car that aren't brought on by a mishap, such as hail damage, theft and vandalism. Accident, Accident insurance protects you by spending for damages to your vehicle if you are at fault in an accident. This holds true whether you are at fault in an accident with another chauffeur or if you encounter a tree, fence or another fixed item.

Full protection often includes both comprehensive and accident insurance. Motorists who have vehicle loan will typically be needed to bring complete protection to guarantee they can settle their loans in case of a mishap. What Is Full Protection Car Insurance Coverage? Full coverage auto insurance is a term utilized to explain a combination of coverage types that safeguard both you and other individuals or residential or commercial property included in an accident.

Despite the terminology, there actually is no such thing as full coverage. All protection types come with deductibles, maximum advantages and other limits that avoid them from covering every possible aspect of every mishap. What Does Full Protection Generally Include? Full coverage is typically utilized to describe having multiple insurance coverage types that supply a wide range of coverage alternatives.

The Liability Only Vs Full Coverages - Direct Auto Insurance PDFs

Even the finest automobile insurer have no basic meaning of full coverage insurance coverage, however it could include a mix of insurance coverage types with some options being incremental to complete coverage: Normal Full Coverage Inclusions, Comprehensive, Comprehensive insurance coverage covers damage to your vehicle not caused by a crash, consisting of weather-related damage, automobile theft and falling things such as tree branches or hail.

Residential Or Commercial Property Damage Liability, Home damage liability insurance covers damages to another person's car if you are at fault in an accident. Physical Injury Liability, Bodily injury liability covers medical bills in case of bodily injury sustained by other individuals in a mishap where you were at fault. Additional Insurance Options, Accident Protection, Often referred to as PIP coverage, accident protection covers medical bills and, sometimes, lost incomes for the driver and guests in your car.

The third number is the total amount your insurance provider will pay for residential or commercial property damage in a mishap. Think of that your liability protection is 50/100/50, and you rear-end another vehicle on the highway with three guests within. 2 of them sustain minor injuries, each needing $1,000 in healthcare, but the 3rd is seriously injured and needs $80,000 worth of treatment.

The 5-Minute Rule for Types Of Car Insurance Coverage & Policies

When Are PIP and Uninsured Driver Protection Required? Each state has different laws and regulations relating to insurance coverage, including what coverage types are required and the minimum level of those protection types you are lawfully allowed to buy. Most of the time, you'll be required to acquire uninsured motorist coverage or accident defense if: You live in a no-fault state like Florida.

Rates of Comprehensive Coverage by State, Money, Geek computed the percent of lorries covered by thorough insurance coverage in every state. We also broke down the number of automobiles that weren't covered with this type of insurance. To discover the variety of registered chauffeurs in each state, we made use of data from the Federal Highway Administration.% of Cars w.

Medical payments are not included under accident coverage. If you run into a fixed object, such as a tree, fence, pole, guardrail or mail box, the damage to your automobile would be covered by collision. Collision coverage pays for damages to your car if you hit a hole. Check the specifics of your policy to confirm the limitations to any hole damage your car may get.

No matter just how much your vehicle costs to change, if you have the cash to pay for a brand-new vehicle out-of-pocket, you may not wish to keep thorough and crash coverage. Think about the 10% guideline. If your premiums are more than 10% of your automobile's money value, specialists say you might want to drop thorough and collision insurance coverage.

How much insurance coverage you require depends on lots of factors, including where you live, how much you drive, who drives your car and how much your vehicle deserves. The laws, guidelines and regulations concerning full protection cars and truck insurance differ from one state to another, so it is vital to get a quote based upon your state.

Little Known Questions About What Does Comprehensive Auto Insurance Cover? - Money ....

https://www.youtube.com/embed/zaI59PjrmUU

Comparing rates based on your state's requirements and options can help you compare quotes and discover protection that best satisfies your requirements. Approach, Automobile Insurance Coverage, Vehicle Insurance, About the Author.

AboutThe 30-Second Trick For Best Cars For Teens: The List Every Parent Needs - Kelley ...

Parents are the Secret to Safe Teenager Drivers. 2 Insurance Institute for Highway Safety. (2018) 3 Insurance Institute for Highway Security.

With this strategy, you receive lessening and waived deductibles, a $10,000 survivor benefit, and other raised advantages. Discounts Among the large selection of discount rates are some rate reductions that will specifically attract parents of teen motorists or young drivers spending for their own insurance coverage policy. These deals consist of: Younger Motorist Discount rates for unmarried drivers more youthful than 21 who deal with their moms and dads, Driving Training Discounts for chauffeurs more youthful than 21 who finish a recognized training course, Erie Rate Lock, which keeps premiums the same every year no matter mishaps, Multi-car and multi-policy discounts of approximately 25% Digital Experience For a smaller insurance business, Erie Insurance provides a decent website that permits customers to do a lot in regards to their policies.

Erie keeps an A+ rating with the Better Company Bureau and a complaint index of 1. 10 from the National Association of Insurance Coverage Commissioners (NAIC), representing a slightly higher than typical level of problems relative to other business in the market. The business has an A+ rating in monetary strength from AM Best.

The Best Strategy To Use For Auto Insurance Advice For Young Drivers In New Jersey

Furthermore, Erie offers a few of the finest premium rates for young driversclose to 60% more affordable than the nationwide average. Clearly, the greatest drawback to Erie Insurance coverage is its minimal availability. Additionally, Erie Insurance coverage does not permit consumers to file automobile claims online: They must call their local agent or use the toll-free number to the corporate service.

Your freshly minted young chauffeur has a license. If you are introducing into a search for the finest automobiles for teenagers, we can help.

(IIHS) to get you into the appropriate frame of mind. In this nation, teenagers drive less than all but the older people, yet, their instances of crashes and crash deaths are unreasonably high.

Car Insurance For Teenagers: What The Guys Need To Know - An Overview

The most considerable danger is at ages 16 and 17. In 2018, 63 percent of deaths among guest automobile residents ages 16 to 19 were motorists of the car. It's everything about security. Any gadget with a web connection is your pathway to getting the scoop on any vehicle you may consider as one for your teenager motorist.

You'll comprehend our process as we work through this story., you will be paying more. There is almost no increase to add a teen to your policy in our 50th state.

And, it's usually more for a male teenager than a female. Obviously, some automobiles are more expensive than others to guarantee. However the bulk of the brand-new driver's included insurance cost is liability protection. That's the coverage that pays for home damage and physical harm to others. There are lots of elements an insurance provider takes into consideration when computing a premium.

An Unbiased View of Teen Drivers In New Mexico Are Deadly Road Hazards

It's important to involve your insurance agent in the process as early as possible to avoid any surprises. Progressive, for example, uses up to a 10 percent discount to students with a Grade B average or much better.

Usually, they integrate class work with direction by a certified driving coach on a closed course. Here is where we go over good sense. You might have reached a point in your life when you are no longer concerned with the lorry you drive, in some way defining or being a reflection of you.

Their lorry desire list will contain all sorts of automobiles, trucks, and SUVs that, whether you can afford them or not, might not be appropriate or safe for them. Going into this task, we set some standards about the automobiles we would consider the very best for teen drivers. Remember that you have to balance the vehicle's expense with the safety features it consists of.

What Does Car Insurance Information For Teen Drivers - Geico Mean?

When you plan your budget plan for a lorry, it might likewise be wise to consider the potential cost of repair work and bodywork. If your family spending plan allows, 2013-and-newer vehicles featured the Big Three safety features: anti-lock brakes, traction control, and stability control, as mandated by the federal government.

City cars and trucks might be more inexpensive and get much better gas mileage than compact or midsize ones. However, in a contest with a full-size truck or SUV on the road, they will always come out 2nd. Sports cars may look cool, however they may tempt your teen to drive beyond his/her skill.

High-horsepower cars and trucks will be high on the essential list for some teen drivers, however even experienced drivers can over-drive their skills on rain-soaked pavement. Increased horsepower translates into greater insurance coverage premiums and more capacity for difficulty.

Not known Details About Best Cars For Teens: The List Every Parent Needs - Kelley ...

It is among the aspects relentlessly rising the sticker label cost of new vehicles. As carmakers pursue driverless vehicles, all way of new innovation to help the driver is leaking into the standard and optional functions list of almost every model. If you and your family can afford to purchase a new vehicle for your teen, search for a vehicle with all of these functions.

The more recent the cars and truck, the better your possibilities. We extremely recommend you look into a cars and truck at Kelley Blue Schedule before buying to see if these features are readily available. They may not come standard if they are, which may imply searching for a mid- or upper trim level. are the foundation of the next two systems.

However, numerous factors work together to enhance a cars and truck's safe operation while lessening chauffeur tension. We have actually noted some of these in our quick vehicle descriptions in the next area. Outboard mirrors with turn-signal signs Power-adjustable chauffeur's seat Tilt-and-telescopic steering wheel Automatic climate control LED headlights and taillights Automatic high beams Adaptive cruise control Hill-start assist Infotainment system with voice recognition Airbags, at least 6 Automobile on-off headlights In addition, a number of carmakers, including Lexus, Volkswagen, Chevrolet, Toyota, Kia, Ford, and Hyundai, use some kind of programmable driving display to help keep an eye on and set limitations for your teenager motorist.

The Only Guide for Should Your Teenager Have Their Own Car Insurance Policy?

https://www.youtube.com/embed/VWHLkBe-O88That's why we focused on lorries that are broken down by cost, from below $20,000 to those that cost less than $5,000. All of our choices for the finest used vehicles for teens under $20,000 come with the advanced security and driver-assist features listed above.

AboutExcitement About What To Do Next When Your Car Is Totaled

To discover the real value of your automobile, you can inspect respectable rates websites. Keep in mind the condition of your cars and truck prior to the accident happened, the present mileage and any other aftermarket elements that you installed as these generally contribute to a vehicle's value. Ensure you have the invoices for such devices when having your settlements.

The adjuster might not have actually understood the added devices to your automobile and will only consider your claim if he sees acceptable documents. You might not need to show any documentation if the preliminary payout quantity used by your insurance provider goes down well with you. Allow Cars And Truck Rental Repayment.

This cost should be covered by your insurance business as it's straight related to the accident that got your cars and truck amounted to. Find out if your insurance business prefers to pay this quantity individually or together with your amounted to car payout. Determine All the Essential Charges. Compute all taxes, registration and title costs on your car.

Faqs Regarding Repairs To Your Vehicle - Ct.gov Can Be Fun For Everyone

Doing this will help you validate if the automobiles were sold for the rates you computed. We 'd recommend you to get about 3 or more estimates.

Just how much your insurance coverage will cover for your amounted to cars and truck is consisted of in their policy's fine print. For you to get the maximum payment for your amounted to cars and truck, you need to know how your insurance business will compute the amount and the choices that are open to you. Replacement Pay-out.

It's a bit challenging to put a definite quantity on your amounted to vehicle however your insurance provider will have its approach for calculating your vehicle's ACV. To figure out the ACV and amounted to worth of your car, your insurance company will utilize your automobile's year, make, design, mileage, and damage done to calculate their results.

If My Car Is Declared A Total Loss, Can I Still Drive It? - Freeadvice Things To Know Before You Get This

If your automobile is old and severely harmed, your insurance provider is most likely to write it off and not trouble repairing it as it will not deserve it. Your insurer determines the cost they can pay based off of previous auction information and the costs of getting rid of the cars and truck.

Let's use our previous example of an amounted to automobile with an ACV of $10,000. 10 percent of this worth would be $1,000. This means that $1,000 and your deductibles would be subtracted from the ACV of your cars and truck to wind up with the quantity that you'll be paidif you wish to keep your totaled automobile.

If you have actually got a loan hanging over your automobile, you 'd require to clear it before getting a new car. You might be fortunate and the payout from your insurance coverage company on your totaled car will be more than the loan balance.

The Single Strategy To Use For How Much Will My Insurance Pay If My Car Was Totaled?

However, if the loan balance exceeds the payment from your insurance provider, then the whole payment will be utilized to clear the loan. You 'd then need to comprise the difference left. A SPACE (Guaranteed Car Security) insurance coverage can save you if you bought one after taking the loan on your car.

How to Utilize Our Online Totaled Vehicle Value Calculator to Figure Out the Rate of Your Totaled Vehicle. If you're trying to find a perfect way to get a good estimate for your amounted to automobile then you're better off with our online totaled vehicle value calculator. You'll get an ensured quote in a minute.

At Offer, Max, you're not pushed to offer your totaled cars and truck when you get an offer from usthe ball is always in your court. You're always welcome to utilize our online amounted to automobile worth calculator to know what your amounted to cars and truck is worth. You'll get a fair deal from us for your cars and truck, no matter the state it remains in.

Excitement About Maine Bureau Of Insurance: Auto Claims - Faqs

It's a bit tough to put a definite quantity on your totaled car however your insurer will have its technique for computing your car's ACV. To identify the ACV and totaled value of your cars and truck, your insurance provider will use your vehicle's year, make, design, mileage, and damage done to compute their results.

If your car is old and severely harmed, your insurer is most likely to write it off and not bother fixing it as it will not be worth it. Your insurer determines the price they can pay based off of past auction data and the costs of eliminating the cars and truck.

Let's utilize our previous example of a totaled car with an ACV of $10,000. 10 percent of this worth would be $1,000. This implies that $1,000 and your deductibles would be deducted from the ACV of your automobile to end up with the amount that you'll be paidif you wish to keep your amounted to automobile.

More About Total Loss Car Insurance Settlements And What You Need To ...

The payment from your insurer has nothing to do with your automobile's loan balance [if you took a loan] If you have actually got a loan hanging over your cars and truck, you 'd need to clear it prior to getting a brand-new automobile. You might be lucky and the payment from your insurance provider on your totaled cars and truck will be more than the loan balance.

Nevertheless, if the loan balance goes beyond the payout from your insurance provider, then the entire payout will be utilized to clear the loan. You 'd then need to make up the difference left. A SPACE (Surefire Automobile Protection) insurance coverage can save you if you acquired one after taking the loan on your automobile.

How to Utilize Our Online Totaled Automobile Worth Calculator to Identify the Price of Your Totaled Vehicle. If you're trying to find an ideal method to get an excellent price quote for your amounted to automobile then you're much better off with our online totaled automobile worth calculator. You'll get a guaranteed quote in a minute.

Unknown Facts About What To Do If Your Car Is Totaled - Illinois Vehicle Insurance

At Offer, Max, you're not pressured to offer your amounted to cars and truck when you get a deal from usthe ball is constantly in your court. You're constantly welcome to use our online totaled vehicle worth calculator to know what your amounted to vehicle deserves. You'll get a reasonable deal from us for your vehicle, no matter the state it's in.

It's a bit difficult to put a certain quantity on your totaled car but your insurer will have its method for computing your automobile's ACV. To figure out the ACV and totaled worth of your automobile, your insurance company will utilize your automobile's year, make, design, mileage, and damage done to calculate their outcomes.

If your cars and truck is old and badly harmed, your insurance provider is most likely to compose it off and not bother repairing it as it will not deserve it. Your insurance provider computes the cost they can pay based off of past auction information and the expenses of getting rid of the car.

Examine This Report about How Much To Buy Back Totaled Car From Insurance

Let's use our previous example of a totaled cars and truck with an ACV of $10,000. 10 percent of this value would be $1,000. This suggests that $1,000 and your deductibles would be subtracted from the ACV of your vehicle to wind up with the quantity that you'll be paidif you wish to keep your totaled car.

The payment from your insurance company has absolutely nothing to do with your cars and truck's loan balance [if you took a loan] If you've got a loan hanging over your cars and truck, you 'd need to clear it prior to getting a new cars and truck. You may be fortunate and the payment from your insurance provider on your amounted to vehicle will be more than the loan balance.

If the loan balance exceeds the payment from your insurance coverage company, then the whole payout will be used to clear the loan. You 'd then have to comprise the distinction left. A GAP (Guaranteed Car Security) insurance can save you if you acquired one after taking the loan on your cars and truck.

Our Can I Just Keep Cash From A Car Insurance Payout And Not Fix ... Diaries

How to Use Our Online Totaled Vehicle Value Calculator to Determine the Cost of Your Totaled Lorry. If you're searching for a perfect method to get an excellent quote for your totaled cars and truck then you're much better off with our online amounted to car worth calculator. You'll get an ensured quote in a minute.

https://www.youtube.com/embed/ULIz_QOc9X4

At Sell, Max, you're not pressed to sell your totaled vehicle when you get a deal from usthe ball is always in your Helpful resources court. You're constantly welcome to utilize our online totaled car worth calculator to understand what your amounted to car deserves. You'll get a fair offer from us for your car, no matter the state it's in.

AboutSome Ideas on How Long Does It Take To Get Car Insurance? - Creditdonkey You Need To Know

While you can and should prepare ahead, you do not wish to cancel your current policy up until the move is made. Follow these steps to prepare for switching vehicle insurance coverage to another state. Collect your documents Ensure all your important documents are easily offered so you're not exploring boxes later.

Call your insurance coverage representative Let them know you're relocating to a new state and inquire about your coverage alternatives in your new home. Get a quote If your present insurance isn't traveling with you, you'll require to start shopping for a new policy that operates in your new state. Do I Need to Change My Cars And Truck Registration If I Move to Another State? When you transfer to another state, your car registration requires to match the place of your new home.

The 10-Minute Rule for Free Car Insurance Quote - Save On Auto Insurance - State ...

If they will, you can take it with you. If your present insurance coverage business doesn't offer insurance in the state you're moving to, you'll need to acquire brand-new coverage when your relocation is complete.

If you're buying new car insurance coverage with an efficient date of April 4, inform your old car insurance coverage to cancel your initial policy efficient April 4. Moving to a brand-new state?

What Does Your Guide To Understanding Auto Insurance In The ... - Nh.gov Mean?

Whether you require instant cars and truck insurance protection due to the fact that your old policy just lapsed, or because you're about to buy a new automobile, you must be able to discover it today with a little legwork. You can compare cars and truck insurance coverage rates immediately to get same-day car insurance. Otherwise, here's what you need to know about instantaneous vehicle insurance.

All of this can be done while you're at the dealer, so don't stress over waiting up until then to purchase same-day protection for a brand-new car. If you're having a tough time finding a business that will offer you same-day automobile insurance protection, focus on bigger ones such as Allstate, GEICO or Nationwide.

What Does Mandatory Insurance Vehicle Services - Illinois Secretary Of ... Mean?

To put it another method,. One exception is that you may pay up to 10% less for an auto insurance plan you buy beforehand if you get it from a business that provides discounts for planning ahead. The length of time does it take to get same-day car insurance coverage? This can be done by filling out a kind online, calling an agent or stepping into your local insurance coverage workplace.

This assumes you wish to insure a basic or common car. If you need specialized insurance coverage for a classic or collector automobile, the procedure could take even longer to the point where you may not have the ability to get same-day coverage. The exact same is real if you can't supply an insurance provider with the details listed above when you call them about a same-day policy.

Not known Details About How Long Does It Take For Auto Insurance To Kick In?

Drivers who are currently insured by another company can ask their new insurance provider to start their coverage at a specific date. What do you need to purchase same-day car insurance online? Prior to you can buy a same-day insurance coverage policy online or otherwise, you have to get a rate quote from an insurance coverage supplier.

If you like your deal, you can consent to buy the policy and have it start right away, however keep in mind to go shopping around to guarantee you receive the best deal. Why can't I get same-day car insurance coverage? There are a couple of factors a company may not offer you same-day vehicle insurance coverage.

The Ultimate Guide To Frequently Asked Questions About Auto Insurance

Larger ones are more likely to use instantaneous automobile insurance protection. You didn't give the insurance business all the info it needs to prepare a quote.

Is same-day vehicle insurance retroactive? No, you can't backdate cars and truck insurance coverage.

Car Insurance - Custom Auto Insurance Quote - Liberty Mutual Things To Know Before You Get This

LLC has made every effort to make sure that the info on this website is correct, but we can not ensure that it is without mistakes, errors, or omissions. All material and services offered on or through this site are provided "as is" and "as readily available" for use. Quote, Wizard. com LLC makes no representations or service warranties of any kind, express or implied, as to the operation of this website or to the information, content, materials, or products consisted of on this site.

You currently own a 2002 Camry and you trade it in for the 2021 Honda. If the Camry is noted on your policy, the Honda will immediately have the same coverage as the Camry for up to 4 days. Beware: If you do not have comprehensive and/or accident protection on the vehicle you are changing, you will not have this protection on your new car.

The smart Trick of Safeco Insurance - Quote Car Insurance, Home Insurance ... That Nobody is Talking About

It's vital to contact your agent prior to your purchase, particularly if you finance or rent the new automobile. If you have actually noted on your policy, your brand-new car will instantly have the best level of coverage of any automobile noted on your policy. Remember, this is for only 4 days with a lot of companies.

If you are acquiring or a brand-new cars and truck and you do not have insurance yet, you will need to get insurance well in advance of driving the car off the lot. Keep in mind, automobile insurance coverage is required in Wisconsin. No, this is likewise your duty. Do not count on the car dealership to do this for you, even if they state they will! Again, you usually have 4 days to notify your agent of your brand-new vehicle purchase.

The smart Trick of How Long Does It Take For Auto Insurance To Kick In? That Nobody is Talking About

It's constantly best to notify your agent beforehand.

The excellent news is that you can get same-day insurance from nearly any leading auto coverage supplier today. In this article, we at the Home Media evaluates team will show you precisely how to get same-day insurance coverage to stay legal on the road.

7 Easy Facts About Insurance - Dmv Shown

https://www.youtube.com/embed/wSBXJQ2RyjcSame-day vehicle insurance protection is no different from basic protection. How to get same-day car insurance You do not need to do anything special to get same-day cars and truck insurance coverage. All it takes is asking for a quote with your total, accurate details and signing up for the policy.

AboutSome Ideas on How Long Does A Car Accident In Tampa, Fl Stay On Your ... You Should Know

When it comes time to actually compose the automobile insurance coverage, the company picked will in all likelihood confirm as much of that information as they can. While your policy will be written as you expect, the other driver will likely be refused or asked to pay a much greater premium once his driving record is confirmed.

Leaving out a major conviction certainly will. Modifications in Your Driving Record, The exact same thing is true when your driving record changes after you have actually acquired a policy. You're typically obliged to tell your insurance provider of any changes so they can change your policy as required. There's no automatic system where the insurer is informed of convictions on your driving record.

All about How Accidents Impact Your Insurance Premium

Think about a motorist who has a DUI conviction throughout the middle of his insurance coverage policy term, and later he's included in an accident needing a claim. Throughout the investigation, the motorist's conviction is found. The insurance provider can invalidate his car insurance protection and deny claim, even if the mishap has nothing to do with alcohol disability.

Just how much do rates increase after a mishap? The response to that depends the way your insurer runs. This rate walking is called an additional charge which is generally a charge tacked onto your premium for entering into a mishap. Here are a few aspects that can affect your rates after an accident: Your business's internal procedures The variety of accident claims you've filed in the previous 5 years The seriousness of the infractions on your record in the past 5 years The overall cost of claims against you For how long Will My Insurance Rates Stay Up After an Accident? Automobile insurance rates can stay elevated after an accident for 3 to five years.

The Ultimate Guide To How Far Back Do Auto Insurance Companies Look?

How to Conserve on Vehicle Insurance Coverage At American Family Insurance Coverage, you've got choices to help reduce the expense of your premium. Have a look at a few of our excellent offerings and discount rates: Utilize accident forgiveness with an excellent driving record We provide accident forgiveness as a method to reward great chauffeurs.

At the time of your accident you will be 100% "forgiven" for one accident per policy and there will be no impact to your premium. The great part about mishap forgiveness is that you're also able to buy this coverage too. That can help to keep your rates down, if your current driving record is less than best.

How How Long Your Car Accident Settlement Will Take - Miller & Zois can Save You Time, Stress, and Money.

Claim Filing FAQs After having a mishap, you have actually probably got a lot on your mind. And you may have a few concerns about what that mishap is going to do to the expense of your vehicle insurance. We have actually got some answers for you:.

Understanding your rights if you have been hurt in a No-Fault accident in Michigan is the initial step to getting the medical treatment, lost earnings, medical mileage and other No-Fault advantages you will need as part of your care, recovery and rehab. This is a complicated area of the law that is frequently confusing and discouraging for vehicle crash victims, even those who have been driving in a No-Fault state like Michigan all of their lives.

The Basic Principles Of How Long Does An Accident Stay On Your Car Insurance?

What is a No-Fault accident? A No-Fault accident is one where a hurt individual no matter fault gets crash-related medical bills, lost incomes and other economic losses paid by his or her own automobile insurance provider, instead of needing to sue the at-fault chauffeur who triggered the crash. There are numerous elements that must be present for to certify, such as whether the crash occurs in a No-Fault state and whether the vehicle included meets the law's definition of a "motor vehicle." However, the two most substantial characteristics/qualifications are: Anybody hurt in such a crash gets his or her crash-related medical expenditures paid and lost wages reimbursed no matter whether he or she was at-fault in triggering and even contributing to the crash.

3105( 4 ))Medical costs and lost wages (as well as other benefits) are paid by the hurt person's car insurance business, not the vehicle insurance provider for the at-fault chauffeur who caused the crash. A No-Fault state is a state that has an auto No-Fault insurance coverage law which guarantees that automobile crash victims will receive medical benefits and lost salaries compensation from their own auto insurance companies regardless of whether they were at-fault in triggering the crash.

Dui-related Accidents And Car Insurance - Nolo Can Be Fun For Everyone

Other states have tort liability systems where, unlike in No-Fault states, cars and truck crash victims should successfully sue the at-fault chauffeur for protection of their crash-related medical costs and lost incomes as well as other economic losses. Substantially, in states without No-Fault, also referred to as pure tort states or tort liability states, if a victim is at-fault in causing the crash, then he or she might be prevented from recuperating anything to cover his or her medical costs and lost incomes.

Does a No-Fault accident go on your record? If you were in fact at-fault in causing the no-fault accident in Michigan, then it will likely be assessed your driving record. How long do car accidents stay on your record? In basic, vehicle accidents in Michigan will remain on your driving record as follows: points on your motorist's license, which will stay there for two years; and/or convictions on your driving record which will remain there for a minimum of seven years.

How Do License Points Affect My Insurance In Georgia? Fundamentals Explained

If you are not at-fault in causing the crash, it will not appear on your driving record. However, if you were you ticketed and founded guilty of violating the Michigan Car Code (and/or identified to have committed a "civil offense"), the crash will appear on your driving record. The key is what your conviction or civil violation is for since the length of time it remains on your driving record will differ based upon how serious the underlying conviction or civil infraction was for.